Owning a property is not only a matter of pride but also a significant financial investment that holds the potential to generate income. For many individuals, one of the key benefits of owning property is the opportunity to earn passive income through rent or other means. However, when it comes to taxes, the income generated from property is classified in a specific manner under Indian tax laws. This blog post will explore what income from house property is and will delve into how individuals calculate it, what exemptions apply, and the tax implications for property owners in India.

Understanding Income from House Property

In simple terms, income from house property refers to the income earned by a property owner from a residential or commercial property. Typically, landlords earn this income by renting out the property or through deemed rent if they do not let out the property but could have. Under the Indian Income Tax Act, this income is taxable, with specific rules governing calculation and declaration.

Components of Income from House Property

Before diving into the specifics of what is income from house property, it is essential to understand the three categories of property covered under this provision:

- Self-Occupied Property: This is the property where the owner or their family resides. The lack of rental income means that authorities levy no tax on this income. However, specific rules apply, especially if the owner holds more than one property.

- Let-Out Property: This refers to the property that has been rented out and generates rental income. The tax authorities consider the rent received from tenants taxable under the “Income from House Property” head.

- Deemed to be Let Out Property: If the owner holds more than two properties but does not rent them out, the system treats the other properties (beyond two) as being let out. We calculate the notional income from these properties based on the market value or expected rent.

Calculation of Income from House Property

To understand what is income from house property, it is essential to know the method of calculation. The formula for calculating this income is straightforward, but tax authorities consider various deductions before they determine taxable income.

- Gross Annual Value (GAV): This is the first step in the calculation process. GAV refers to the higher value between actual rent received or reasonable expected rent from the property. For self-occupied properties, we consider the GAV to be nil.

- Municipal Taxes: Any taxes paid to local authorities, such as property tax, are deducted from the Gross Annual Value. You can make this deduction only if you have paid the taxes during the financial year.

- Net Annual Value (NAV): Once the municipal taxes are deducted from the GAV, the resulting figure is known as the Net Annual Value. This value is crucial in determining the taxable income.

- Deductions: Two main deductions are available under the Income from House Property section:

- Standard Deduction: A standard deduction of 30% is allowed on the Net Annual Value. This deduction covers expenses like maintenance and repairs, irrespective of whether the owner actually incurs them.

- Interest on Home Loan: If someone purchases the property using a home loan, they can deduct the interest paid on the loan. For let-out properties, the entire interest amount is deductible. However, for self-occupied properties, the maximum deduction allowed is ₹2 lakh.

- Taxable Income: After accounting for the above deductions, we consider the remaining amount taxable income under the “Income from House Property” head.

Exemptions and Benefits for Property Owners

Now that we understand what is income from house property, let’s explore exemptions that reduce tax liability significantly.

- Self-Occupied Property: As mentioned earlier, there is no tax on the income from self-occupied properties. If a person owns multiple self-occupied properties, they can declare only two as self-occupied.

- Section 24(b): The interest paid on home loans is eligible for deduction. For let-out properties, this can be a significant tax-saving tool, as the entire interest amount is deductible. The authorities set the cap on the deduction for self-occupied properties at ₹2 lakh.

- Repairs and Maintenance: A 30% standard deduction is allowed, but actual repair expenses are not considered for further deductions. This simplifies the tax filing process for property owners.

Implications of Multiple Properties

One of the common queries regarding what is income from house property is how the rules apply when an individual owns multiple properties. Indian tax laws state that owning more than two self-occupied properties makes additional ones deemed let out. This means even if not rented, the owner must declare notional rent based on similar local property market value.

For instance, if a person owns three properties, they can declare two as self-occupied. Even if vacant, the authorities deem the third property let out, calculating and taxing the notional rent accordingly.

The Importance of Proper Documentation

Property owners who want to make the most of tax deductions and exemptions need to ensure proper documentation. This includes maintaining records of rent agreements, municipal tax receipts, and home loan statements. When filing returns, accurate documentation helps in claiming deductions without any issues from the tax authorities.

Conclusion

Understanding what is income from house property is essential for every property owner in India. Whether self-occupied or rented, it’s vital to understand the rules on income generated and eligible tax deductions. By taking advantage of deductions like the standard deduction and interest on home loans, property owners can significantly reduce their tax liability. Additionally, proper documentation and accurate calculation are key to ensuring compliance with the tax laws.

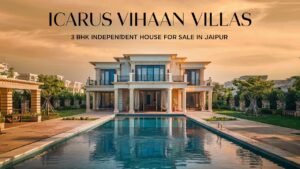

Icarus Builders believes owning property is not only about comfort but also maximizing your valuable investment potential. With our luxurious Icarus Dev Vihan Villas, located in Bhankrota, Jaipur, we offer a unique opportunity to own a prime property that combines luxury with the potential for passive income. Each JDA-approved villa has over 2600 sq. ft., offering luxury and potential income for smart home investments.

If you’re wondering what is income from house property, investing in a well-located property like Icarus Dev Vihan Villas can be a smart financial move. Explore the luxury, convenience, and financial benefits of owning one of our exclusive villas today.

Read Also: What is Independent House